![]()

![]()

Share This Page

Aged parent says, "I'm not moving!" but lives in a cash poor retirement?

Submitted by Phil McDowell on Thu, 07/22/2010 - 16:59

You are not alone if you feel crushed by the needs of your children and now your parent(s).

There are many determined seniors who just will not listen to the advice: " Please, sell the home you have owned and lived in for years."

"Take the money and live in a home that does not need the physical strength to get around that this home needs. Stop worrying about an increase of property tax because the pension is not big enough and the bank account is not high enough to take extra expense hits."

Who would have thought these old folks would get so stubborn!

They may have tried to borrow money from the bank they have dealt with for years. They were probably told that they either did not have the income to pay the loan back; or, did not have a credit rating to adjudicate the loan decison; or- both!

And, even if the bank gave the loan it may be painful for them. Even if the loan repayment was an interest only line of credit, your parents would be seeing the monthly interest charge being deducted from the cash they borrowed. It probably will drive them nuts because they have not been borrowers for so long. It is psychologically painful for them to see the drain on their bank account.

- What if they could have a loan that has no need an income or credit test to qualify? Loan amounts are determined on the value of the home and age of the applicant, not their income or credit rating.

- or

- What if the loan has no monthly payments? The interest accumulates until paid.

- or

- What if the loan has no need to be repaid until your parent(s) decided for themselves they need to move? There is no maturity date that demands the balance in full.

- or

- What if the ownership equity is kept because the loan could be paid in full from the sale of the home, if they died before moving? Parents retain title to the home and after the loan is paid in full, the balance of home sale proceeds goes to the estate.

- or

- What if the parents later ask you to buy the home, if you want to? The mortgage needs to be paid in full at the time of title transfer.

- or

- What happens if house values fall because there is a real estate market crash? You parents can remain in the home with no monthly payments until they decide to move out or if they die.

- or

- What happens if your parents remain in good health and want to stay for years, and years and years and years, but house prices are flat and declining to the point more money is owed on the mortgage than the house is worth? That's the lender's problem. Parents get to stay.

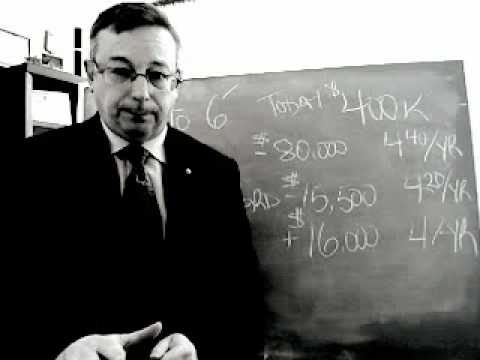

The video used a "what if" example of your parent's home being worth $400,000 today. They borrow $120,000 so they are not in a cash poor retirement. Today, they would have equity remaining in the home of $280,000 and have $120,000 in cash. $400,000 in home equity has been split into home equity and cash.

BIG ASSUMPTION- if the house value goes up by 3% a year, in five years the house is worth $463,000. No loan payments have been made for five years so the accumulated interest has made the loan balance $163,000. The equity in the home is $300,000. This is up from the home equity of $280,000 five years ago.

Of course, some of the $120,000 cash gained five years ago is gone. In five years, what ever is left of the cash and the after sale equity of the home is still your parents. If they moved out or if the home was an estate sale, the cost of selling the house is the same- with or without a loan.

Let's say 3% annual house price is an assumption you do not believe to be true. You have a different assumption.

Tell us your assumption, and we will have the answer to what you ask- "What is left for the folks or the estate?"